Investing thematically in the world’s potential

Global reach with local impact

- 66 Funds investing in major world economies

- 220+ Institutional investors around the world

- 33 Offices in 9 countries

Focused on sectors vital to the future

We thematically invest today in evolving sectors that we predict will play an integral role in the economy well into the future. Our global reach and local market knowledge give us considerable insight into alternative asset classes, enabling us to make better decisions, orchestrate some of the industry’s largest transactions, and deliver attractive returns for investors.

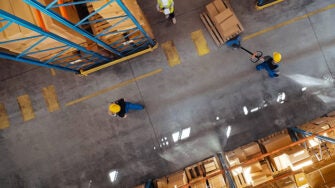

Logistics

Rapid growth in global commerce and e-commerce depends on logistics real estate equity investment. With evolving market conditions magnifying the importance of supply chain efficiency, demand is only increasing.

Through our investments in global logistics properties, as well as innovative, emerging technologies that add value to these logistics assets, we seek to lead the way in this segment.

Digital infrastructure

Alongside scientific discoveries, medical advancements, new and more accessible financial services, global commerce and now the AI revolution, demand for data center real estate continues to rise exponentially.

We are at the forefront of digital infrastructure investing through our dedicated data center platforms.

Energy transition

Countries and corporations worldwide are making an unprecedented commitment to a net-zero emissions future.

Starting with the real estate that we already own, we’re dedicated to pursuing renewable energy investment opportunities that respect the environment.

Our investment platform

Our diversified investments include a dual focus on real assets and private equity. Our investments span the risk spectrum and include Core and Core Plus, Value-Add, and Opportunistic strategies.

Real assets

Leveraging our global scale, local presence and proprietary intelligence, we identify and execute attractively priced investment and development opportunities across our funds.

Our partnership with GLP as a global logistics real estate operator also directly informs and enhances our investments, further driving strong performance.

Private equity

As an early mover in new economy sectors, we invest in high-potential businesses that are innovating in these sectors.

These include modern logistics services and distribution platforms, as well as technologies that aim to improve supply chain efficiencies. Then, we look to deploy these capabilities in our managed real assets.

Our private equity businesses

Our private equity strategy includes both our growth equity and venture capital investments.

One of our largest private equity platforms is Hidden Hill Capital in China, which was established in 2018 to make investments in logistics services, digital supply chain and logistics-related technology in the region.

Additionally, Monoful is our venture capital platform in Japan that invests in growth-stage start-ups in the logistics and real estate ecosystem. Portfolio companies include robotics, artificial intelligence, fintech and e-commerce.